how to lower property taxes in nj

By learning how property taxes are computed in New Jersey however you can investigate whether the assessed value of your home is too high and the basis of an excessive property tax bill. New Jerseys high property taxes are notorious and in 2020 they hit a new high.

Lower property taxes to make home ownership more affordable New Jersey can and should be a place where our residents can afford to live and work for generations.

. If you maintain all other eligibility requirements you will have to file Form PTR-1 next year to re-establish yourself in the program using the lower property tax amount as your new base year. New Jersey doesnt have to continue to be the butt of jokes and derision by the leaders of more fiscally disciplined states. County Tax Board Information.

This will restore funding so that municipalities can lower the amount they are required to raise through taxes or lower property taxes altogether Also approved by the committee was legislation S-343 that would increase the tax deduction for renters. 544-226 property is assessed for taxation at a percentage of its true value set by each County Board of Taxation. By law at NJSA.

Related

It allowed us to create a login and enter the evidence including. Rasmussen said the average New Jersey renter who pays 1500 per month 18000 annually in rent would be able to deduct 2100 more than they would under current law. Encourage residents to support local businesses while at.

As one example property taxes could be reduced by over 8 simply by aligning public employee health benefits and retirement savings plans to what the rest of New Jerseyans feel lucky to receive from their employers. Hunterdon County collects the highest property tax in New Jersey levying an average of 852300 191 of median home value yearly in property taxes while Cumberland County has the lowest property tax in the state collecting an average tax of 374400 213 of median. Municipal tax rates generally go up slightly each year.

Property Tax in New Jersey. 24 percent Health and welfare 19 percent Your property tax has a purpose funding local government. If New Jersey switched all local employees to such a gold plan governments could cut property taxes by nearly 9 percentthats 25 billion in spending at the county and local levelwhile still providing health benefits on the high end.

Uniform agencies including police fire sanitation and corrections 5 percent Education 5 percent Other agencies including transportation housing parks etc. To appeal your propertys assessment File Form A-1 and Form A-1 Comp. The exact property tax levied depends on the county in New Jersey the property is located in.

Property taxes are established by 2 factors the tax assessment on the property which generally does not change other than during the year of a municipal wide tax revaluation and the municipal tax rate. On the towns website we quickly found the link to enter an online appeal with the countys board of taxation. New Jerseys real property tax is an ad valorem tax or a tax according to value.

Tax Account InquiryPrint a Tax Bill. Municipalities across New Jersey have found a way to do the impossible. Short of moving to a smaller home or another state appealing the assessment of a property is how homeowners can lower their tax bills said Anthony DellaPelle a partner at McKirdy Riskin Olson.

ACH is now available. An annual 250 deduction from property taxes is available for the property of a qualified senior citizen disabled person or surviving spouse who meet certain income requirements. Dont build or make changes to your curbside just before an assessment as these steps may increase your value.

Residents may call their County Tax Board for more information. The measure would change the deduction for rent payments considered as property taxes from 18 to 30. Click here for application.

The standard measure of property value is true value or market value that is what a willing knowledgeable buyer would pay a. Senior Citizen - Age 65 or more as of December 31 of the pre-tax year. All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land.

Give the assessor a chance to walk through your homewith youduring your assessment. As Governor I will lower your property taxes through comprehensive reform of our broken school funding formula a system where 60 of state aid goes to just 5 of the districts is unsustainable Jack. In some situations you might even be able to challenge the assessment and lower your bill.

You report your gross property tax amount due and paid for the year indicated on the form. The costs are way out of line with private sector plans Byrne said. Sale with the County Board of Taxation.

Filing the appeal. What amount do I report for my property taxes gross or net. All 21 counties in New Jersey have chosen 100 as the level at which property is to be assessed for local tax purposes.

Senior Citizen Disabled Person and Surviving Spouse are defined as follows. Your tax increase is likely a result of your municipalitys tax rate increases over. But in these 30 towns taxpayers pay anywhere from half to.

830 am - 430 pm Monday - Friday. If youre a state resident your property tax dollars may go to.

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

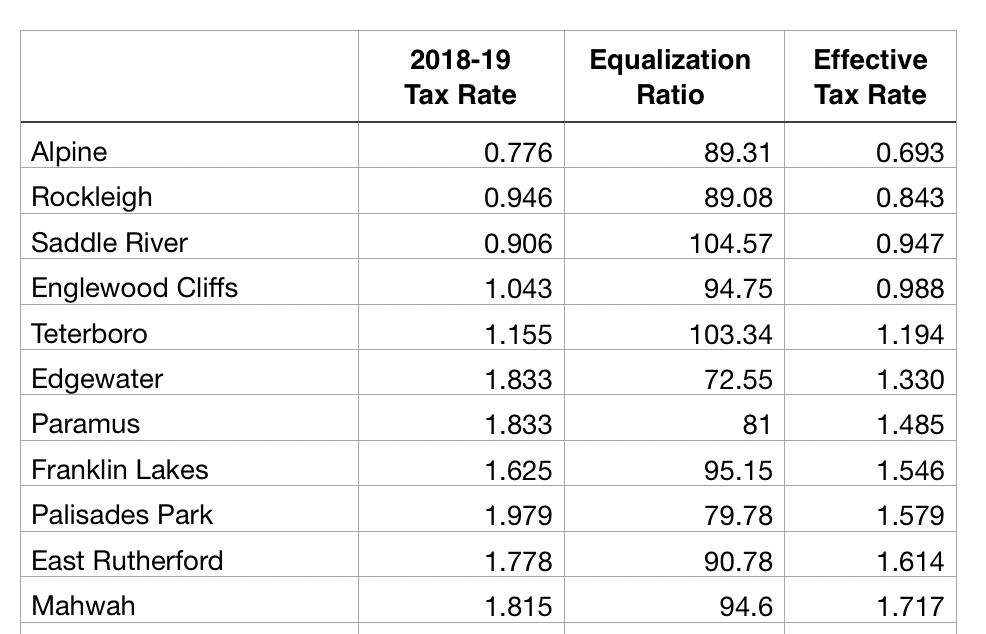

Bergen County Tax Rates For 2018 2019 Michael Shetler

Nj Property Tax Relief Program Updates Access Wealth

Why Are Nj Property Taxes So Incredibly High When It Is The Most Densely Populated State In The Country Shouldn T Nj Residents Pay Less Property Tax Since There Are More People Per

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Lower Property Taxes Jack Ciattarelli For New Jersey

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com